Do you know what would happen if you were involved in a car accident and didn’t have automobile insurance? It’s not a situation you want to find yourself in, that’s for sure. Automobile insurance is something that all drivers should have in order to protect themselves, their passengers, and their vehicles. In this article, we’ll dive into the basics of automobile insurance and why it’s important to have coverage. Whether you’re a new driver or just want to brush up on your knowledge, you’re in the right place to learn more.

When it comes to automobile insurance, there are a few key things you should know. First and foremost, it’s a legal requirement in most states to have at least a minimum amount of coverage. This is to ensure that if you cause an accident, you have the means to compensate the other party for any damages or injuries they may have suffered. Without insurance, you could face hefty fines, license suspension, or even legal trouble. Additionally, automobile insurance provides financial protection for you and your vehicle in case of an accident, theft, or damage caused by natural disasters. Whether it’s repairing your car or paying for medical expenses, having insurance can save you from significant financial burdens. So, buckle up and get ready to dive deeper into the world of automobile insurance in our upcoming article.

What is Automobile Insurance?

Automobile insurance, also commonly referred to as car insurance or auto insurance, is a type of insurance coverage that is designed to protect individuals and their vehicles in the event of accidents, theft, or other unexpected incidents. It is a legal requirement in many countries to have automobile insurance if you own and operate a motor vehicle.

Definition of Automobile Insurance

Automobile insurance provides financial protection in the form of coverage for liability, physical damage, medical expenses, and other related expenses. It is an agreement between the insured (the policyholder) and the insurance company, where the insured pays a premium in exchange for the insurer’s promise to compensate for covered losses or damages.

Importance of Automobile Insurance

Automobile insurance is important for several reasons. Firstly, it helps to provide financial protection against unexpected and potentially significant financial losses. Without insurance, individuals would have to bear the full cost of repairing or replacing their vehicles if they are involved in an accident. Additionally, automobile insurance also provides liability coverage, which protects individuals from having to pay out of pocket for damages or injuries they may cause to others.

Secondly, automobile insurance is a legal requirement in many jurisdictions. Driving without insurance can lead to severe legal penalties, including fines, suspension of driving privileges, and even imprisonment in some cases. Therefore, having automobile insurance is not only important for financial protection but also for compliance with the law.

Types of Automobile Insurance Coverage

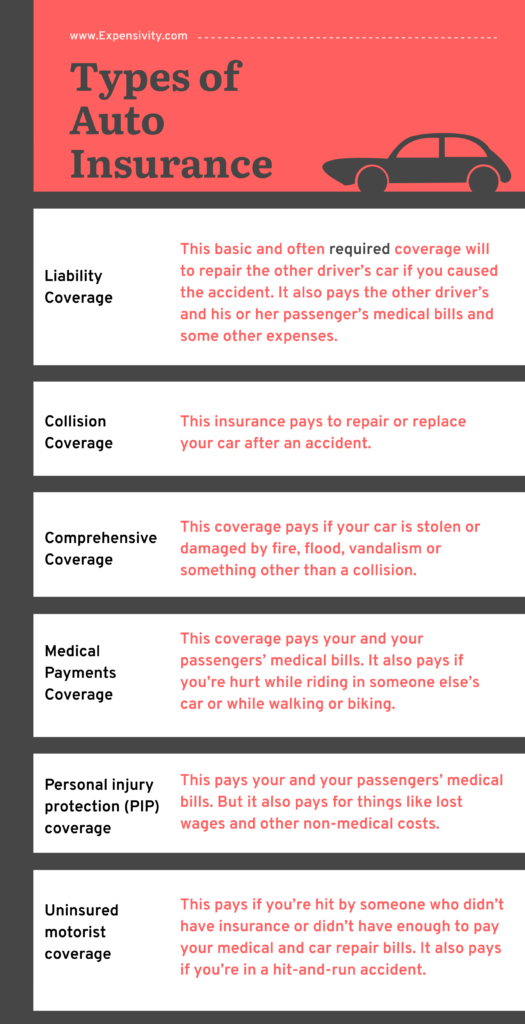

There are several types of automobile insurance coverage available, each serving specific purposes.

Liability Coverage:

Liability coverage is the most basic and necessary type of automobile insurance coverage. It provides financial protection if you are at fault in an accident and cause damage to someone else’s property or inflict injuries on them. It helps to cover the cost of repairs to the other person’s vehicle, medical bills, and legal fees if you are sued.

Collision Coverage:

Collision coverage is an optional type of coverage that helps to pay for repairs or replacement of your vehicle if it is damaged in a collision, regardless of fault. It covers damages caused by hitting another vehicle or object, such as a tree or a fence.

Comprehensive Coverage:

Comprehensive coverage is also optional and provides protection against damages to your vehicle that are not caused by a collision. It covers damages caused by events such as theft, vandalism, fire, natural disasters, and falling objects.

Uninsured/Underinsured Motorist Coverage:

Uninsured/underinsured motorist coverage is designed to protect you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. It helps to pay for your medical expenses and vehicle repairs in such situations.

Medical Payments Coverage:

Medical payments coverage, also known as MedPay, is optional and covers the medical expenses for you and your passengers if you are injured in a car accident, regardless of fault. It helps to cover expenses such as hospital bills, doctor visits, and medications.

Personal Injury Protection:

Personal injury protection, also known as PIP, is similar to medical payments coverage but is typically required in no-fault insurance states. It provides broader coverage, including medical expenses, lost wages, and caregiving expenses resulting from an accident.

Factors Affecting Automobile Insurance Premiums

When determining the cost (premium) of your automobile insurance policy, insurance companies take several factors into consideration. These factors can vary from one insurer to another, but here are some common ones:

Driving Record

Your driving record is one of the most significant factors affecting your automobile insurance premiums. If you have a history of traffic violations, accidents, or other driving offenses, insurance companies consider you a higher risk, and your premiums will likely be higher. On the other hand, a clean driving record can lead to lower premiums.

Age and Gender

Age and gender are also important factors. Younger drivers (especially teenagers) and male drivers tend to have higher insurance premiums due to their statistically higher involvement in accidents. Older drivers and female drivers typically have lower premiums.

Type of Vehicle

The type of vehicle you drive significantly impacts your insurance premiums. Cars with higher values, higher horsepower, or those considered more prone to theft or accidents (e.g., sports cars) will generally have higher insurance premiums. On the other hand, vehicles with good safety ratings and those equipped with advanced safety features can potentially earn you discounts.

Location

Where you live and primarily drive can affect your insurance premiums. Insurers consider the level of traffic, crime rates, and accident statistics in your area. Urban areas with higher accident rates and crime rates often result in higher premiums compared to rural areas.

Credit Score

In some jurisdictions, insurance companies may use credit scores as a factor when determining premiums. Generally, individuals with higher credit scores are considered less risky and, therefore, may enjoy lower insurance premiums.

Understanding Automobile Insurance Coverage

Understanding the different types of automobile insurance coverage is essential to ensure you have adequate protection in case of an accident or other unexpected events. Here’s a breakdown of the various types of coverage discussed earlier:

Liability Coverage

Liability coverage is the foundation of your automobile insurance policy. It includes bodily injury liability, which covers injuries you cause to others, and property damage liability, which covers damages to other people’s property caused by you. These coverages are typically expressed as a series of numbers representing the maximum coverage amounts.

Collision Coverage

Collision coverage is not required by law, but it is essential if you want your insurance company to pay for damages to your vehicle caused by a collision, regardless of fault. It typically has a deductible (the amount you must pay out of pocket) before the insurance company starts to pay.

Comprehensive Coverage

Comprehensive coverage is also optional but provides protection against damages to your vehicle that are not caused by a collision. This includes damages caused by theft, vandalism, fire, natural disasters, or falling objects. Like collision coverage, comprehensive coverage typically has a deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who either does not have insurance or does not have enough insurance to cover the damages. It covers your medical expenses and vehicle repairs in such situations.

Medical Payments Coverage

Medical payments coverage, or MedPay, provides coverage for you and your passengers’ medical expenses if you are injured in an accident, regardless of fault. It typically has a lower coverage limit and helps cover expenses such as hospital bills, doctor visits, and medications.

Personal Injury Protection

Personal injury protection, or PIP, is designed to cover medical expenses, lost wages, and caregiving expenses resulting from an accident. It is typically required in no-fault insurance states and provides broader coverage compared to medical payments coverage.

Determining the Right Automobile Insurance Policy

Choosing the right automobile insurance policy can be overwhelming, but it is crucial to have adequate coverage to protect yourself and your vehicle. Here are some factors to consider when determining the right policy for you:

Factors to Consider

The first factor to consider is your specific needs and circumstances. Assess your driving habits, the value of your vehicle, your budget, and any unique considerations (such as a long commute) that may impact your insurance needs.

Evaluating Coverage Needs

Evaluate your coverage needs for each type of coverage discussed earlier. Consider the minimum legal requirements in your jurisdiction and assess whether additional coverage is necessary based on your personal circumstances.

Comparing Insurance Quotes

Obtain quotes from different insurance companies to compare premiums, coverage limits, deductibles, and any additional benefits or discounts offered. Make sure to read the fine print and understand the terms and conditions of each policy before making a decision.

Common Automobile Insurance Terms

Understanding common automobile insurance terms can help you navigate the process and ensure you make informed decisions. Here are some terms you may come across:

Deductible

A deductible is the amount you agree to pay out of pocket before your insurance coverage starts. For example, if you have a $500 deductible and incur $2,000 in damages, you would pay the first $500, and the insurance company would cover the remaining $1,500.

Premium

The premium is the amount you pay for your insurance coverage. It is usually paid monthly, quarterly, or annually and is based on factors such as your driving record, the type of vehicle, your location, and coverage limits.

Policy Limit

The policy limit refers to the maximum amount of coverage your insurance policy provides. For example, if your policy has a $100,000 liability coverage limit, the insurance company will pay up to $100,000 for damages or injuries caused by you.

Claim

A claim is a formal request you make to your insurance company to seek compensation for covered damages or injuries. It typically involves providing documentation and evidence to support your claim.

Underwriting

Underwriting refers to the process insurance companies use to evaluate your risk and determine your premium. It involves assessing your driving record, credit score, age, and other relevant factors.

Exclusion

An exclusion is a provision in your insurance policy that specifies certain situations or circumstances that are not covered. It is essential to review your policy to understand any exclusions that may affect your coverage.

Endorsement

An endorsement, also known as a rider or a floater, is a modification or addition to your insurance policy. It can be used to add or change coverage, extend policy limits, or include additional insured parties.

Steps to File an Automobile Insurance Claim

In the unfortunate event of an accident, it is important to know how to effectively file an automobile insurance claim. Here are the general steps involved:

Contacting the Insurance Company

As soon as possible after the accident, contact your insurance company to report the incident. Provide details about the accident and any injuries or damages sustained. They will guide you on the necessary steps and documentation required.

Gathering Necessary Information

Collect and document all relevant information, such as the other party’s contact and insurance information, witness statements, police reports, and photos of the accident scene and damages. This information will be crucial when filing your claim.

Filing the Claim

Submit your claim to the insurance company, either through an online portal, by mail, or over the phone. Provide accurate and detailed information about the accident, injuries, and damages. Include any supporting documents you have gathered.

Working with an Adjuster

After filing your claim, an insurance adjuster will be assigned to assess the damages and determine the appropriate compensation. Cooperate with the adjuster by providing any additional information or documentation they request.

Resolving the Claim

Once the adjuster evaluates the damages and liability, they will make a settlement offer based on your policy coverage limits, deductibles, and any applicable exclusions. You can accept the offer and receive payment, negotiate for a higher settlement if necessary, or proceed with legal action if you believe you are not being adequately compensated.

Saving Money on Automobile Insurance

Automobile insurance premiums can be a significant expense. Here are some tips to help you save money on your insurance:

Maintaining a Good Driving Record

Maintaining a clean driving record by avoiding accidents, traffic citations, and other driving offenses can help you secure lower insurance premiums.

Choosing a Higher Deductible

Opting for a higher deductible means you will pay more out of pocket in the event of a claim. However, it can help lower your premiums.

Taking Advantage of Discounts

Insurance companies offer various discounts, such as safe driver discounts, multi-policy discounts (if you bundle multiple policies with the same company), and discounts for completing defensive driving courses. Take advantage of these discounts to save money.

Bundling Policies

Consider bundling your automobile insurance policy with other policies, such as homeowners or renters insurance, with the same insurance company. This can often lead to discounts on both policies.

Regularly Reviewing Coverage

Review your insurance coverage annually or whenever there are significant changes in your circumstances (such as buying a new vehicle or moving). Ensure your coverage aligns with your current needs and make adjustments if necessary.

Understanding Premium Factors and Discounts

Insurance premiums are influenced by various factors. Some of the most common factors that can affect your automobile insurance premium include:

Factors Influencing Premiums

- Age and driving experience

- Vehicle make, model, and value

- Driving record and claims history

- Location

- Credit score

- Gender

- Marital status

Common Automobile Insurance Discounts

Insurance companies often offer discounts that can help reduce your premiums. Some common discounts include:

- Safe driver discounts for having a clean driving record

- Defensive driving course discounts for completing an approved defensive driving course

- Multiple policy discounts for bundling multiple policies, such as auto and homeowners insurance

- Good student discounts for students who maintain good grades

- Anti-theft device discounts for installing anti-theft devices in your vehicle

- Low mileage discounts for drivers who drive fewer miles annually

Consequences of Driving Without Automobile Insurance

Driving without automobile insurance can have severe consequences, both legally and financially. Here are some potential consequences of not having insurance:

Legal Penalties

Driving without insurance is illegal in many jurisdictions and can result in penalties such as fines, license suspension, vehicle impoundment, and even imprisonment, depending on the severity of the offense and the jurisdiction.

Financial Risks

If you cause an accident without insurance, you may be personally responsible for paying for the damages, injuries, and other related expenses out of pocket. This could lead to significant financial hardship and potentially bankrupting you.

Conclusion

Automobile insurance is a vital protection for vehicle owners. It provides financial coverage in case of accidents or other unexpected events, helps comply with legal requirements, and offers peace of mind. Understanding the different types of coverage, factors affecting premiums, and ways to save money can help you make informed decisions and ensure you have the right level of protection for your needs. Remember to review your policy regularly and adjust as necessary to ensure you are adequately covered.