So, you’re interested in car insurance discounts, huh? Well, you’re in luck! In this article, we’ll be diving deep into the world of car insurance discounts and uncovering all the secrets you need to know to save some serious cash. Whether you’re a first-time driver or a seasoned pro, there are plenty of ways to get those monthly premiums down. So buckle up and get ready for the ultimate guide to car insurance discounts!

In this article, we’ll be exploring the different types of car insurance discounts available, from good driver discounts to multi-policy discounts. We’ll break down each discount and explain how you can qualify for them. We’ll also discuss the importance of shopping around and comparing quotes from different insurance providers to ensure you’re getting the best possible deal. By the end of this guide, you’ll be armed with all the knowledge you need to start slashing those insurance costs. So, stay tuned and get ready to become a discount-savvy driver!

The Ultimate Guide to Car Insurance Discounts

Understanding Car Insurance Discounts

Car insurance can be quite expensive, but luckily, there are several ways to save money on your premiums. One of the most effective ways is by taking advantage of car insurance discounts. These discounts are offered by insurance companies to reward certain behaviors, characteristics, or affiliations that they consider to be lower risk. In this guide, we will explore the different types of car insurance discounts, how they work, and why insurance companies offer them.

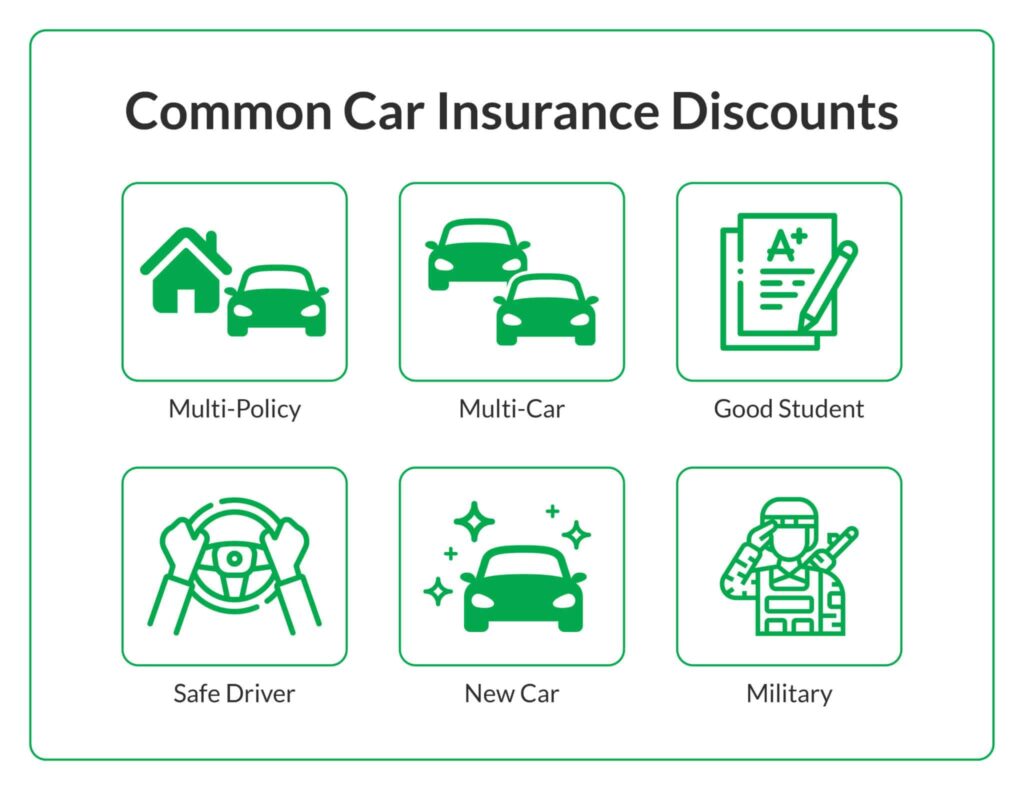

Different Types of Car Insurance Discounts

Car insurance discounts can vary from one insurance provider to another, but there are some common types that are widely available. Understanding these different types can help you determine which discounts you may be eligible for and how they can reduce your premium costs. Here are the main categories of car insurance discounts:

How Car Insurance Discounts Work

Car insurance discounts work by reducing the amount of the premium that you have to pay. When you qualify for a discount, the insurance company will subtract a certain percentage or dollar amount from your premium. For example, if you have a $1,000 premium and qualify for a 10% discount, your premium will be reduced to $900.

Why Car Insurance Companies Offer Discounts

Car insurance companies offer discounts as a way to attract and retain customers. By rewarding customers for certain behaviors or affiliations, insurance companies can encourage safer driving habits, loyalty, and lower risk factors. Additionally, offering discounts can be a marketing tactic for insurance companies to differentiate themselves from competitors and attract new customers.

Common Car Insurance Discounts

Good Driver Discount

One of the most common car insurance discounts is the good driver discount. This discount is given to drivers who have a clean driving record with no accidents or traffic violations within a certain time period. Insurance companies view this as an indicator of a responsible and low-risk driver.

Multi-Policy Discount

Insurance companies often offer a multi-policy discount for customers who have multiple policies with their company. For example, if you have both car insurance and homeowners insurance with the same company, you may be eligible for a discount on both policies.

Safe Vehicle Discount

If your vehicle is equipped with certain safety features, such as anti-lock brakes, airbags, or an anti-theft system, you may qualify for a safe vehicle discount. These features are designed to reduce the risk of accidents or theft, making you a lower-risk customer.

Good Student Discount

Students who maintain good grades may also be eligible for a good student discount. Insurance companies believe that students who excel academically are likely to be responsible and low-risk drivers.

Military Discount

Many insurance companies offer discounts to active duty military personnel and veterans as a way to show appreciation for their service. These discounts can vary, but they can provide significant savings on car insurance premiums.

Less Common Car Insurance Discounts

While the common car insurance discounts mentioned above are widely available, there are also some less common discounts that you may be eligible for. These discounts may not be offered by all insurance companies, but it’s worth checking if you qualify. Here are a few examples:

Pay-In-Full Discount

If you pay your annual premium in full upfront instead of in monthly installments, you may be eligible for a pay-in-full discount. This discount rewards customers who can afford to make a lump sum payment and reduces the administrative costs for the insurance company.

Paperless and Online Discount

Insurance companies are increasingly offering discounts to customers who choose to receive policy documents and communications electronically. By going paperless and managing your policy online, you can help reduce costs for the insurance company, which they pass on to you in the form of a discount.

Low Mileage Discount

If you don’t drive your car often or have a low annual mileage, you may qualify for a low mileage discount. Insurance companies consider low mileage drivers to be at a lower risk of accidents or incidents.

Occupational Discounts

Some insurance companies offer occupational discounts to certain professions that are considered low risk. These professions can vary, but they typically include teachers, nurses, police officers, and firefighters.

Membership Discounts

Certain organizations or memberships may entitle you to car insurance discounts. Examples include alumni associations, professional organizations, or automobile clubs. Check with your insurance company to see if they offer any membership discounts.

How to Qualify for Car Insurance Discounts

Qualifying for car insurance discounts requires meeting certain criteria set forth by the insurance company. These criteria vary depending on the type of discount, but here are some general guidelines to help you qualify for discounts:

Maintaining a Clean Driving Record

To qualify for the good driver discount, you need to have a clean driving record without any accidents or traffic violations within a specific timeframe. Avoiding speeding tickets, accidents, and other violations can help you maintain a clean driving record and qualify for this discount.

Bundling Policies

To qualify for the multi-policy discount, you need to have multiple policies with the same insurance company, such as car insurance and homeowners insurance. Bundling your policies can not only save you money but also make you eligible for this discount.

Choosing a Safe Vehicle

When purchasing a new car, consider choosing one with safety features that can qualify you for a safe vehicle discount. Features like anti-lock brakes, airbags, and an anti-theft system can make you eligible for this discount.

Maintaining Good Grades

If you’re a student, maintaining good grades can help you qualify for the good student discount. Make sure to provide your insurance company with proof of your academic achievements to take advantage of this discount.

Having a Military Affiliation

If you’re an active duty military member or a veteran, make sure to inform your insurance company to see if you qualify for a military discount. Providing the necessary documentation can help you take advantage of this discount.

Tips for Maximizing Car Insurance Discounts

To make the most of car insurance discounts and save as much money as possible, here are some tips to keep in mind:

Check for Available Discounts

Insurance companies may offer different discounts, so it’s important to check what discounts are available to you. Contact your insurance company or check their website for a list of available discounts and eligibility requirements.

Compare Quotes from Multiple Insurers

Different insurance companies have different discount offerings and pricing structures. It’s a good idea to compare quotes from multiple insurers to find the best rates and discounts for your specific situation.

Consider Usage-Based Insurance Programs

Some insurance companies offer usage-based insurance programs where your premium is based on your actual driving habits. By participating in these programs and demonstrating safe driving behavior, you may receive additional discounts.

Maintain Good Credit

Insurance companies often use credit scores as a factor in determining premiums. Maintaining good credit can help you qualify for lower rates and discounts. Pay your bills on time, limit your debt, and monitor your credit report for any errors.

Regularly Review and Update Your Policy

Circumstances can change over time, so it’s important to regularly review your car insurance policy. Update your policy if you have changes in your driving habits, coverage needs, or eligibility for additional discounts.

Potential Limitations and Exclusions for Car Insurance Discounts

While car insurance discounts can help you save money, it’s important to be aware of potential limitations and exclusions. Here are a few things to consider:

Specific Eligibility Criteria

Each discount may have specific eligibility criteria that you must meet. Make sure to review the requirements and ensure that you meet them before expecting a discount.

Discount Caps and Limits

Some discounts may have caps or limits on the amount you can save. The maximum discount may vary depending on the insurance company and the specific discount.

Duration of Discounts

Discounts may not be permanent and can be subject to change or expiration. Some discounts may only apply for a certain period of time or may require periodic renewals.

Geographical Restrictions

Certain car insurance discounts may only be available in specific geographical areas. Make sure to check if a discount is available in your location.

Policy Changes and Impact on Discounts

Certain changes to your policy, such as adding a new driver, changing vehicles, or moving to a different location, may impact your eligibility for certain discounts. Make sure to notify your insurance company of any changes to avoid losing any discounts.

Frequently Asked Questions about Car Insurance Discounts

What is the average discount offered by car insurance companies?

The average discount offered by car insurance companies can vary depending on the type of discount and the insurance provider. Discounts typically range from 5% to 25% off the premium.

Can I combine multiple discounts?

In many cases, insurance companies allow customers to combine multiple discounts, which can result in significant savings on their premiums. However, it’s important to check with your insurance provider to confirm their specific policies on combining discounts.

Will the discounts be automatically applied?

In most cases, you will need to inform your insurance company of your eligibility for specific discounts. They will then adjust your premium accordingly. Make sure to provide any necessary documentation to prove your eligibility for discounts.

Can I lose my discount?

Yes, discounts can be lost if you no longer meet the eligibility criteria or if there are changes to your policy that impact your eligibility. It’s important to maintain the requirements for each discount to continue receiving them.

How often should I review my policy to ensure I’m getting all available discounts?

It’s a good practice to review your car insurance policy at least once a year to ensure you are getting all available discounts. However, if you experience any changes in your circumstances, it’s important to review your policy sooner to update your coverage and take advantage of any new discounts.

Conclusion

Utilizing car insurance discounts can significantly reduce your premium costs while still maintaining adequate coverage. By understanding the different types of discounts available, how to qualify for them, and tips for maximizing your savings, you can make informed decisions and save money in the long run. Remember to regularly review your policy, check for available discounts, and compare quotes from multiple insurers to ensure you’re getting the best rates possible.