Looking for the best car insurance deal but don’t know where to start? Look no further! In this article, you will discover the ease and convenience of comparing car insurance quotes online. Gone are the days of spending hours on the phone or visiting multiple insurance offices. With just a few clicks, you can access a variety of quotes from different insurers, allowing you to make an informed decision and potentially save some serious cash. So, buckle up and get ready to embark on a journey towards finding the perfect car insurance for you!

Understanding Car Insurance Quotes

What are car insurance quotes?

Car insurance quotes are estimates provided by insurance companies that outline the cost of insuring your vehicle. They typically include information on the coverage options, deductibles, and premiums that you can expect to pay. Car insurance quotes serve as a starting point to help you understand the financial implications of different insurance policies and make an informed decision about which one best suits your needs.

Why are car insurance quotes important?

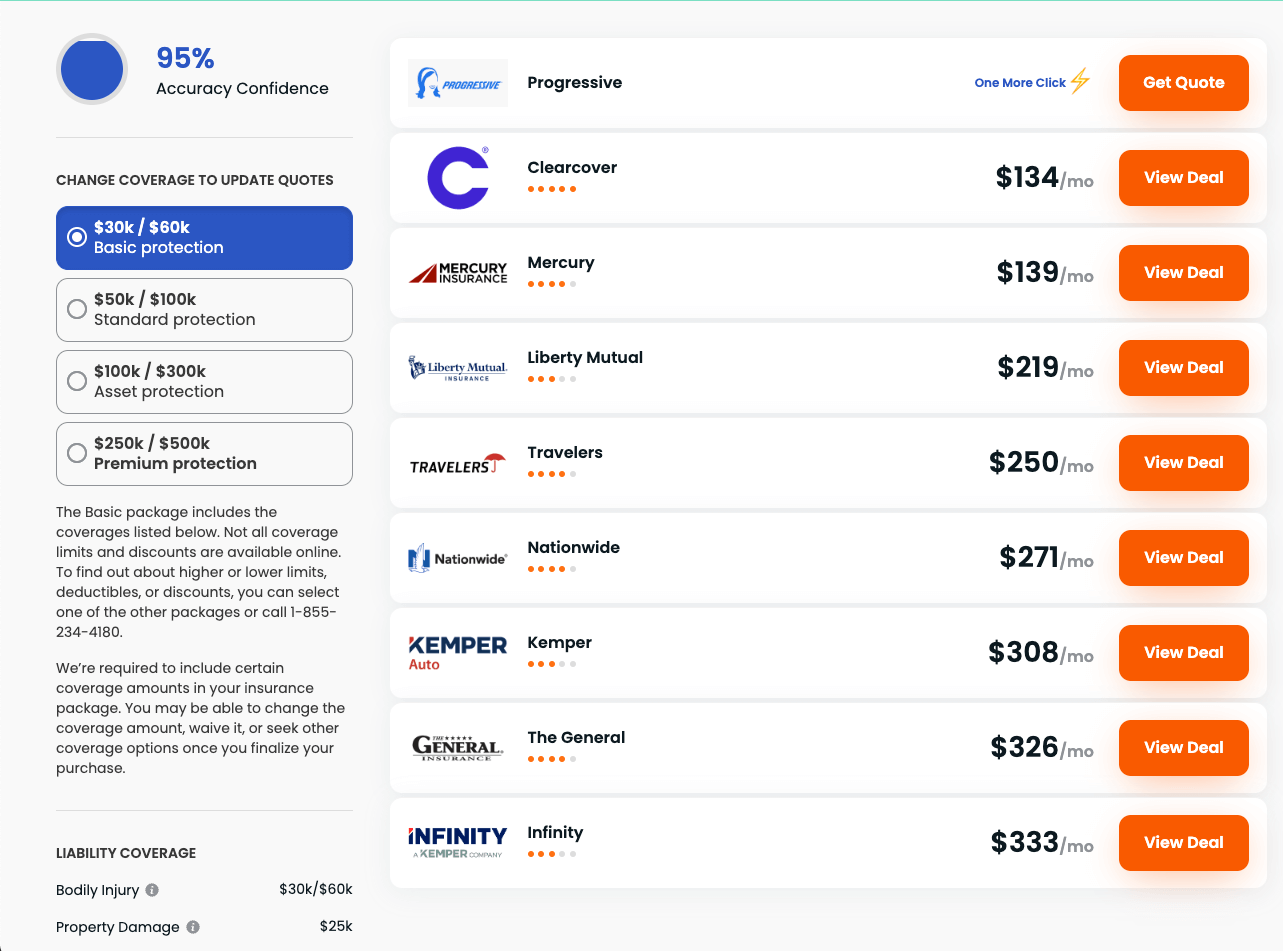

Car insurance quotes are important because they allow you to compare the costs and coverage options offered by different insurance providers. By obtaining multiple quotes, you can evaluate the value and affordability of each policy and choose the one that offers the best protection for your vehicle without breaking the bank. Car insurance quotes also enable you to understand the factors that affect the cost of insurance, helping you make adjustments to your coverage options or driving behavior if necessary.

Types of car insurance quotes

There are different types of car insurance quotes available, depending on the level of coverage you require and your driving history. The three most common types of car insurance quotes are:

-

Third-Party Liability Insurance: This is the most basic type of car insurance and covers the damages and injuries sustained by others in an accident where you are at fault.

-

Collision Coverage: This type of car insurance covers the repair or replacement costs for your vehicle in the event of a collision, regardless of who is at fault.

-

Comprehensive Coverage: Comprehensive coverage provides protection for your vehicle against theft, vandalism, natural disasters, and other non-collision-related damages.

Factors affecting car insurance quotes

Several factors can affect the cost of car insurance quotes. Insurance providers consider these factors when determining the level of risk associated with insuring a specific driver. Some common factors include:

-

Driving Record: Your driving history and any previous accidents or violations can impact your car insurance quotes. Drivers with a clean record typically receive more favorable quotes.

-

Vehicle Type: The make, model, and age of your vehicle can affect car insurance quotes. Luxury or high-performance cars may have higher premiums due to increased repair costs.

-

Geographic Location: Insurance providers take into account where you live and park your vehicle. Urban areas or regions with higher crime rates may result in higher car insurance quotes.

-

Age and Gender: Younger drivers, especially teenage males, tend to have higher car insurance quotes due to their perceived higher risk of accidents.

-

Credit Score: Some insurance companies consider your credit score when calculating car insurance quotes. Maintaining a good credit score may help lower your premiums.

-

Coverage Limits: The amount of coverage you select will impact your car insurance quotes. Higher coverage limits typically result in higher premiums.