Looking for car insurance but don’t have the funds for a hefty down payment? Don’t worry, we’ve got you covered! In this article, we will explore the world of affordable car insurance options that require no down payment. Whether you’re a new driver or simply looking to switch insurance providers, we’ll help you find the perfect plan that fits your budget. Say goodbye to the stress of upfront costs and hello to peace of mind on the road. Let’s get started!

Understanding No Down Payment Car Insurance

What is no down payment car insurance?

No down payment car insurance is a type of insurance policy that allows you to start your coverage without making a down payment or paying the premium upfront. With traditional car insurance policies, you are typically required to make a down payment or pay the first month’s premium before your coverage begins. However, with no down payment car insurance, you can get immediate coverage without the financial burden of an upfront payment.

How does it work?

When you choose a no down payment car insurance policy, you essentially agree to pay your premiums on a monthly basis instead of making a larger upfront payment. Instead of paying a lump sum at the beginning of your coverage period, you will pay smaller monthly installments throughout the year. This can be a convenient option for those who may not have the means to pay a large sum upfront but still need immediate coverage for their vehicle.

Is it a good option?

Whether no down payment car insurance is a good option for you depends on your individual financial circumstances and needs. While it may seem like an attractive option to avoid making a large upfront payment, it’s important to consider the potential drawbacks. No down payment car insurance often comes with higher monthly premiums compared to policies that require a down payment. Additionally, some insurance providers may charge fees or interest for spreading out your payments over the year. It’s important to carefully weigh the pros and cons before deciding if this type of insurance is the right choice for you.

Pros and cons

There are several pros and cons to consider when it comes to no down payment car insurance.

Pros:

- Immediate coverage without the need for a large upfront payment

- Financial flexibility with monthly premium payments

- Accessibility for those who may not have the means to make a down payment

Cons:

- Higher monthly premiums compared to upfront payment policies

- Potential fees or interest charges for spreading out payments

- Long-term cost implications may be higher due to increased premiums

Finding Affordable Car Insurance Options

Research and compare insurers

One of the first steps in finding affordable car insurance options is to research and compare different insurance providers. Take the time to gather information about the reputation, customer service, and available coverage options of various insurers. This will help you make an informed decision about which insurer offers the best value for your needs.

Consider your coverage needs

Before purchasing car insurance, it’s important to evaluate your specific coverage needs. Consider factors such as the age and condition of your vehicle, your driving habits, and the risks you may encounter on the road. By understanding the coverage options available and assessing your needs, you can choose the most appropriate coverage for you, while also ensuring it fits within your budget.

Check for discounts and savings opportunities

Insurance providers often offer various discounts and savings opportunities to help you lower your premiums. Look for discounts such as multi-policy discounts (when you bundle multiple insurance policies), good driver discounts (for maintaining a clean driving record), safety features discounts (for vehicles equipped with certain safety features), and low mileage discounts (for drivers who drive fewer miles annually). Taking advantage of these discounts can substantially reduce your insurance costs.

Review customer reviews and ratings

When considering different insurers, take the time to review customer reviews and ratings. This can provide valuable insight into the experiences of other policyholders and the level of service you can expect. Look for insurers with positive feedback and high customer satisfaction ratings, as this indicates a reliable and customer-oriented insurance provider.

Obtain personalized quotes

Once you have narrowed down your options, it’s important to obtain personalized quotes from the insurance providers you are considering. Provide accurate information about yourself, your vehicle, and your coverage needs to ensure the quotes reflect the most accurate pricing. By comparing quotes from multiple insurers, you can find the most affordable car insurance option that meets your requirements.

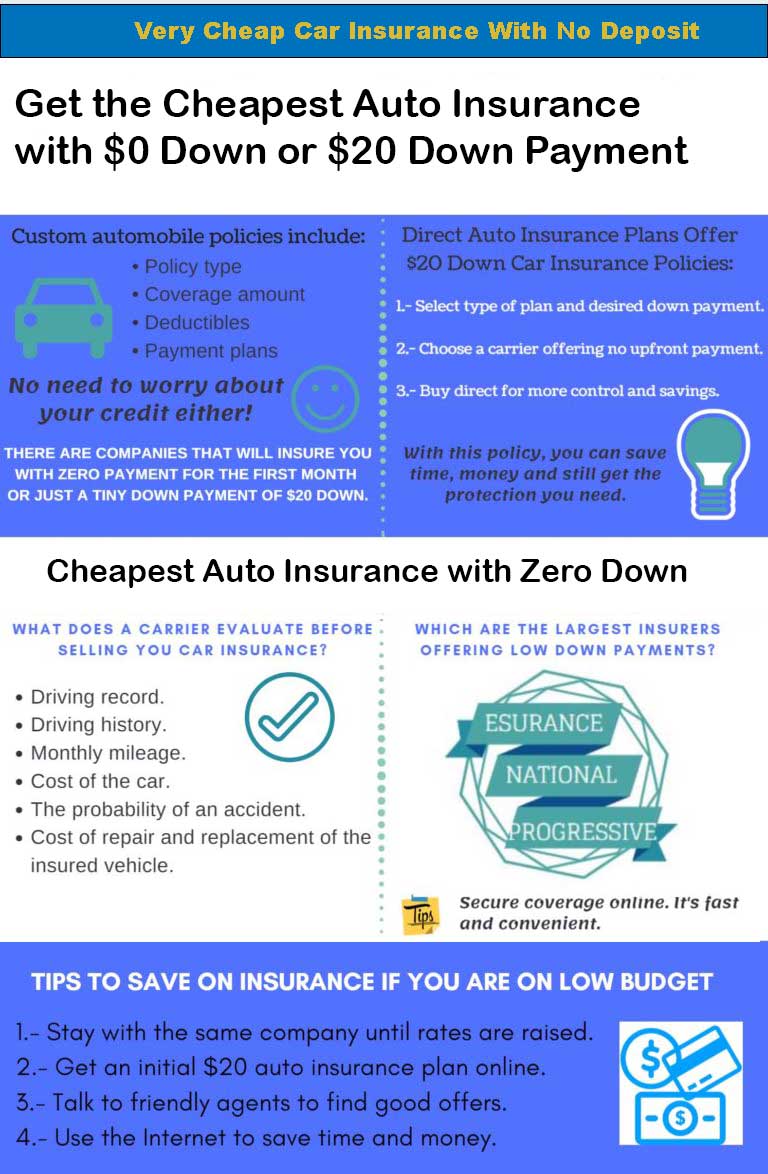

Factors Affecting Car Insurance Rates

Driving record

Your driving record plays a significant role in determining your car insurance rates. Insurance companies will review your history of accidents, traffic violations, and claims to assess how risky of a driver you are. Drivers with a clean record and no history of accidents or traffic violations are generally considered lower risk and may qualify for lower insurance premiums.

Vehicle make, model, and age

The type of vehicle you drive can also impact your car insurance rates. Insurance companies assess the risk associated with the make, model, and age of your vehicle. Generally, newer and more expensive vehicles require higher premiums since they may be costlier to repair or replace. Additionally, cars with advanced safety features and security systems may be eligible for discounts, as they reduce the risk of accidents or theft.

Location

Where you live can affect your car insurance rates. Insurance companies consider factors such as the frequency of accidents, theft rates, and the overall crime rate in your area when determining premiums. Urban areas with higher population densities and higher rates of accidents or theft may have higher insurance rates compared to rural areas.

Credit score

Believe it or not, your credit score can impact your car insurance rates. Insurance providers often consider credit scores as an indicator of financial responsibility. Drivers with good credit scores are generally seen as less likely to file claims and may be eligible for lower premiums. It’s important to maintain a good credit score by paying bills on time, reducing outstanding debt, and regularly checking your credit report for errors.

Insurance history

Your insurance history can also influence your car insurance rates. Insurance providers may consider factors such as the length of time you have been insured, any lapses in coverage, and your claims history. Drivers with a history of continuous coverage and few or no claims are often perceived as lower risk and may qualify for lower premiums.

Types of Car Insurance Coverage

Liability coverage

Liability coverage is typically the minimum coverage required by law in most states. This coverage helps protect you financially if you are responsible for causing injuries or property damage to others in an accident. Bodily injury liability coverage pays for medical expenses, pain and suffering, and lost wages for the injured party, while property damage liability coverage helps cover the cost of repairing or replacing the other party’s vehicle or property.

Collision coverage

Collision coverage helps cover the cost of repairs to your own vehicle if it is damaged in a collision with another vehicle or object, regardless of fault. This coverage is especially important if you have a newer or more valuable vehicle that would be costly to repair or replace.

Comprehensive coverage

Comprehensive coverage provides protection for damage to your vehicle that is not the result of a collision. It covers events such as theft, vandalism, natural disasters, and damage caused by hitting an animal. Comprehensive coverage is typically required if you have a loan or lease on your vehicle.

Uninsured/underinsured motorist coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who either has no insurance or does not have enough insurance to cover your damages. This coverage helps pay for medical expenses, lost wages, and other damages that you would otherwise have to pay out of pocket.

Personal injury protection

Personal injury protection, or PIP, is a type of coverage required in some states. It helps cover medical expenses, lost wages, and other costs associated with injuries sustained in an accident, regardless of who is at fault. PIP coverage can provide valuable financial protection, especially if you do not have health insurance.

Discounts and Savings Opportunities

Multi-policy discount

Many insurance providers offer a multi-policy discount if you have multiple insurance policies with them. Bundling your car insurance with other policies such as homeowner’s insurance or renter’s insurance can result in significant savings.

Good driver discount

Maintaining a clean driving record can earn you a good driver discount. Insurance companies often offer lower premiums to drivers who have avoided accidents and traffic violations over a certain period of time.

Safety features discount

Vehicles equipped with certain safety features may qualify for discounts on car insurance. Features such as anti-lock brakes, airbags, anti-theft systems, and electronic stability control can reduce the risk of accidents and theft, making your vehicle less expensive to insure.

Low mileage discount

If you do not drive your car often or have a low annual mileage, you may be eligible for a low mileage discount. Insurance companies consider lower mileage to be associated with a lower risk of accidents, leading to potentially lower premiums.

Payment options discount

Some insurance providers offer discounts for paying your premiums in full or setting up automatic payments. By taking advantage of these payment options, you can save money on your car insurance premiums.

Minimum Car Insurance Requirements

State-specific requirements

Car insurance requirements vary by state, so it’s important to familiarize yourself with your state’s specific minimum requirements. Each state sets its own minimum coverage limits and may have additional requirements for certain types of coverage.

Mandatory coverage types

While the specific requirements vary, most states require drivers to have a minimum amount of liability insurance coverage. Some states may also require uninsured/underinsured motorist coverage or personal injury protection.

Minimum liability limits

Liability insurance typically has two coverage limits, such as 25/50/25, which stands for $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 per accident for property damage. These limits represent the minimum coverage required, but it’s often recommended to carry higher limits for better protection.

Penalties for non-compliance

Failure to maintain the minimum required car insurance coverage can result in severe penalties, including fines, suspension of your driver’s license, and even impoundment of your vehicle. It’s crucial to comply with the insurance requirements in your state to avoid legal and financial consequences.

Tips for Lowering Car Insurance Premiums

Raise your deductibles

Opting for a higher deductible can help lower your car insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you assume more responsibility for covering costs in the event of an accident, which can lead to lower premiums.

Maintain a good credit score

As mentioned earlier, your credit score can affect your car insurance rates. Maintaining a good credit score can help you qualify for lower premiums. Pay your bills on time, reduce your outstanding debt, and regularly check your credit report for any errors that may need to be corrected.

Bundle insurance policies

Consider bundling your car insurance with other insurance policies, such as homeowner’s insurance or renter’s insurance, with the same provider. Insurance companies often offer discounts for bundling policies, resulting in lower overall premiums.

Eliminate unnecessary coverage

Review your car insurance policy to identify any unnecessary coverage that you may be paying for. If you have an older vehicle with a low market value, it may not make financial sense to carry comprehensive or collision coverage. By eliminating unnecessary coverage, you can reduce your premiums.

Drive safely and maintain a clean record

One of the most effective ways to keep your car insurance premiums low is to drive safely and maintain a clean driving record. Avoid accidents, traffic violations, and claims whenever possible. Many insurance providers offer discounts to drivers with a safe driving history.

Non-Traditional Car Insurance Options

Pay-per-mile insurance

Pay-per-mile insurance is a type of car insurance that charges premiums based on the number of miles you drive. It involves installing a telematics device in your vehicle that tracks your mileage. This can be a cost-effective option for drivers who do not drive frequently or have a low annual mileage.

Usage-based insurance

Usage-based insurance, also known as telematics insurance, utilizes technology to monitor your driving behavior. By tracking factors such as your speed, acceleration, braking, and mileage, insurance companies can offer personalized premiums based on your driving habits. Safe drivers may qualify for lower rates, while risky behaviors could result in higher premiums.

Telematics programs

Some insurance providers offer telematics programs that allow you to track your driving habits and receive feedback. These programs may provide insights into your driving behavior and offer tips for improving your habits. They can be a valuable tool for becoming a safer driver and potentially lowering your insurance premiums.

Peer-to-peer car insurance

Peer-to-peer car insurance is a relatively new concept that allows individuals to share the costs of insurance within a community of drivers. This type of insurance pools premiums from a group of drivers, and claims are paid from this pooled fund. Peer-to-peer car insurance can provide cost savings for responsible drivers who are willing to share the financial risks.

Steps to Obtain No Down Payment Car Insurance

Find insurers offering no down payment plans

To obtain no down payment car insurance, you need to find insurance providers that offer this type of plan. Research and compare different insurance companies to see if they provide the option for no down payment coverage. It’s important to ensure that the insurer is reputable, financially stable, and offers the coverage you need.

Provide necessary information for a quote

Once you have identified insurance providers that offer no down payment options, you will need to provide the necessary information to obtain a quote. The insurer will typically ask for details such as your personal information, vehicle information, driving history, and coverage requirements. Providing accurate and detailed information will ensure that you receive the most accurate quote possible.

Evaluate the terms and conditions

When evaluating no down payment car insurance options, it’s important to carefully review the terms and conditions of the policy. Pay attention to factors such as the monthly premium, coverage limits, deductibles, and any additional fees or charges associated with the no down payment arrangement. Understanding the terms of the policy will help you make an informed decision.

Purchase the policy

Once you have compared quotes, evaluated the terms and conditions, and selected the best option for your needs, you can proceed with purchasing the no down payment car insurance policy. Contact the insurance provider to finalize the details, make the necessary payments, and ensure that your coverage takes effect on the desired start date.

Considerations when Opting for No Down Payment Car Insurance

Higher monthly premiums

One of the main considerations when opting for no down payment car insurance is the higher monthly premiums. Since you are not making an upfront payment, the cost of your insurance will be spread out over the course of the year. This can result in higher monthly payments compared to policies that require a down payment. It’s important to assess your budget and determine if the higher monthly premiums are feasible for you.

Long-term cost implications

While no down payment car insurance can provide immediate coverage without a large upfront payment, it’s essential to consider the long-term cost implications. Higher monthly premiums can add up over time, potentially resulting in more significant costs compared to policies that require a down payment. Carefully evaluate your financial situation and consider whether the convenience of no down payment insurance outweighs the potential long-term costs.

Financial readiness for unexpected expenses

No down payment car insurance may free up some immediate cash flow by eliminating the need for a down payment, but it’s important to consider your financial readiness for unexpected expenses. Without an upfront payment, you may need to be prepared for larger deductibles or out-of-pocket expenses in the event of an accident or claim. Ensure that you have the financial means to cover these potential costs.

Managing policy cancellations and renewals

When opting for no down payment car insurance, it’s important to be diligent in managing your policy cancellations and renewals. Failure to make monthly premium payments can result in a lapse in coverage or cancellation of your policy. This can leave you without insurance and potentially put you at risk legally and financially. Make sure that you are committed to making regular payments and keeping your policy active throughout the coverage period.

In conclusion, understanding your options when it comes to car insurance is crucial for finding the most affordable coverage. Whether you decide to explore no down payment car insurance, traditional policies, or non-traditional options, it’s important to research different insurers, assess your coverage needs, and explore potential discounts. By taking the time to find the right insurance coverage and understanding the factors that affect your rates, you can make an informed decision and secure the most suitable car insurance policy for your needs and budget. Remember to regularly review your insurance coverage to ensure that it continues to meet your needs and provides you with adequate financial protection.